If history is any indication of future performance, does short-term history count? I’m not sure; however, I’m willing to gamble with AI superstars such as NVDA & SMCI using one strategy as described below.

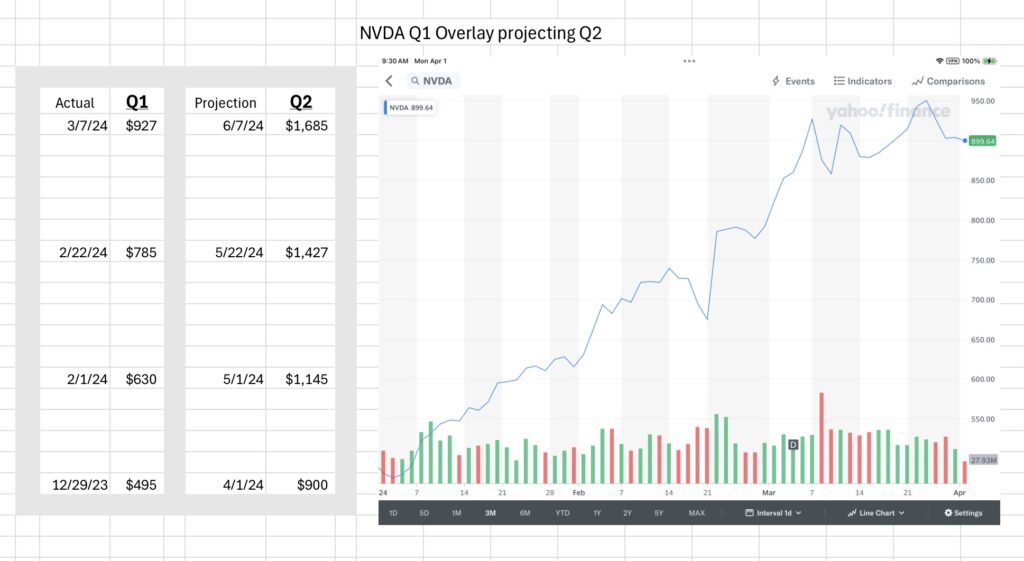

NVDA has had some impressive gains in the past several months. What I have in mind for future wins is an overlay, using the percentage gains from the first quarter of 2024, and mapping that to the second quarter of 2024as shown in the accompanying image. One example is NVDA, growing 27.27% in the first month of Q1 (January). If that happens again for the first month of Q2 (April) the stock would move from today’s opening price of $900 to approximately $1,145. Two other examples are also detailed below.

RISK – Trading options may result in potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options markets. Do NOT trade with money you can’t afford to lose.