I say yes! After bottoming-out, get ready for $150 per share by year end!

September is historically the worst month of the year for Wall Street, and 2024 should be no different . . . with the exception of Nvidia. The stock has, in my opinion, bottomed-out. NVDA is now back up some 10%, so from where I sit, I’m back in the game, trading Nvidia options.

Do you remember back in Q1-2024 when Super Micro Computer Inc. SMCI was skyrocketing? I certainly do as I plotted a daily stock run of appx 5.14% over the course of one day less than three weeks. Similar to cycling, Nvidia was drafting the leadership of SMCI. Following both closely, my strategy was simple; during the run-up and on each of three Wednesdays, buy CALL options expiring the following Friday and sell for the best gain I could one day before expiration; rinse and repeat. I was able to do this three times with substantial gains on each of three trades with NVDA and/or SMCI with one of the trades growing some 40X from $340 to $13,720.

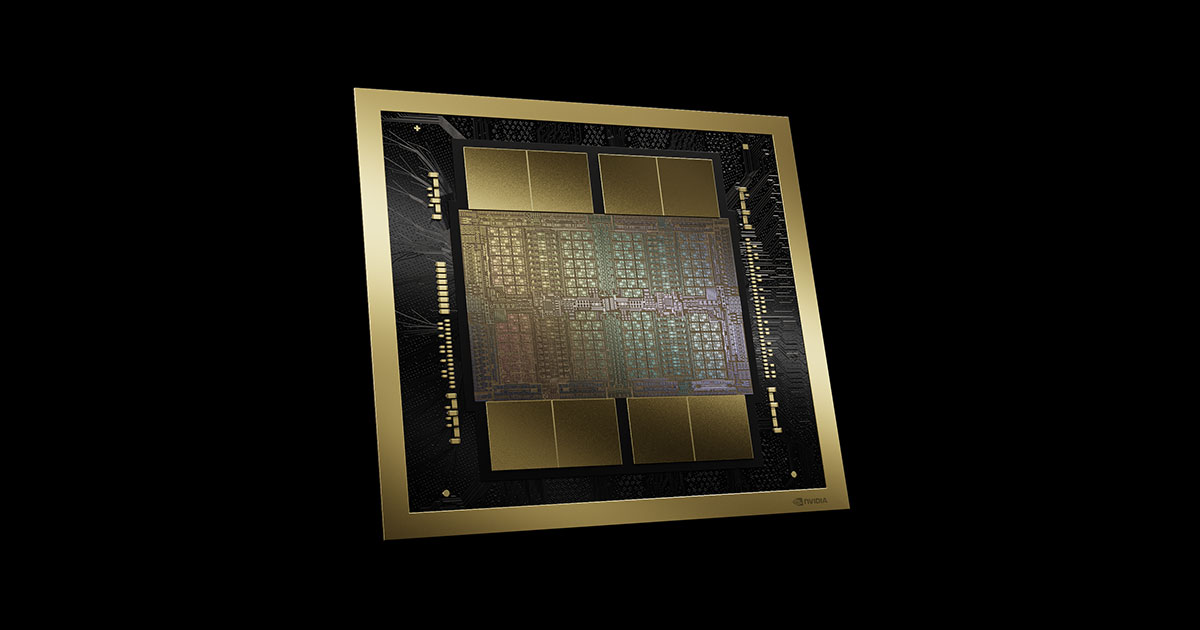

Next, smart people do the math as well as read as much about the fine details as possible to see what’s really go on in a stock and/or industry. For example, it is true that Nvidia chips are incredibly expensive,. However, they are absolutely needed for the required processing speed of artificial intelligence. Further, when compared to what I’ll call an “old school data center”, one Nvidia rack might replace an entire data center building and that’s a ton of hardware to include servers, racks, chips and cables. What we called the TCO or total cost of ownership during my Xerox selling days of the mid 1990s is needed here to place an accurate value for Nvidia products and services.

My take with Nvidia is really simple. Based on history, product need, market dominance, and common sense, look for Nvidia stock to end the year over $150, reach $300 by year-end $2025, end 2026 over $600 as well as $1,200 and another 10:1 split sometime in 2027.

This A.I. party is just getting started. As Dan Ives of Wedbush Securities likes to point out “it’s not 1999 here, it’s more like 1996. We’re not in the 9th inning, the guys are just warming up on the field and the game hasn’t even started!”

RISK – Trading options may result in potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options markets. Do NOT trade with money you can’t afford to lose.