Directional Momentum Long-Term Equity Anticipation Securities or DM-LEAPs . . .

As an options trader, I study and implement lots of trading strategies. Statistically, my trades fail most of the time, about 85%. However, my 15% win-rate sometimes pays-off BIG when I do win. I just want to have the best batting average in my craft and be the 2024 Bobby Witt Junior of derivatives trading, batting 332.

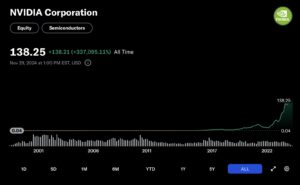

After some extensive research with everybody’s A.I. darling, Nividia, I just implemented some trades using my new DM-LEAPs strategy. These long-term options make sense to me with Nvidia’s continuing remarkable run. Looking back, Nvidia has grown some 337,095% since January of 1999 (below).

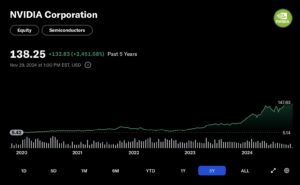

More near term, Nvidia has grown 2,451% in the past 5 years (below).

Finally, Nvidia has nearly tripled, growing 187% in just one year (below).

Nvidia is still moving up and according to some industry experts like Beth Kindig, “it’s is the best stock of the decade and we’re only four years in”.

With expertise from Beth, my research from 2018 about when to invest in a visionary, the directional momentum of Nvidia, and Fibonacci math principles, I’m going long with these DM-LEAPs to a year from December as detailed below.

Today’s NVDA stock price close was $138.63 – Option Expiration Date of December 19th, 2025 – Fibonacci numeric of a 61.8% increase takes us to a Strike Price of $224. One contract currently costs $9.15 x 100 or $915 plus fees and commissions. If Nvidia doubles in 2025 then this option could be worth $53 x 100 or $5,300 less fees & commission for an approximate 5.8-Fold win.

RISK – Trading options may result in potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options markets. Do NOT trade with money you can’t afford to lose.