With recent tariff implementations and global market disruptions, how can investors make money? It’s quite simple. Market volatility is similar to ocean waves . . . no point in jumping in the water to surf when there are no waves. However, add some waves (volatility), and it’s time to surf. Where there is one big wave, there will be many, many more (trades) to follow.

One method is to trade the CBOE Volatility Index (VIX) which is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX). Keep in mind that this is a reverse index, so when the market has a very strong trading day, the VIX usually goes down, and when the market has a terrible day, the VIX usually goes up.

https://www.investopedia.com/terms/v/vix.asp

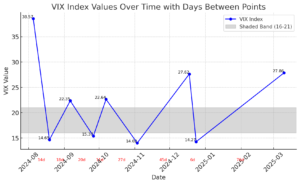

I like picking a VIX (also shown as $VIX) trading range such as a few points above and below the current 30-45 day average and then playing a few hundred bucks on both sides (as shown in the image below). It’s a ton of fun and I have been lucky in this space to the tune of 83% of the time. For this particular options trade, consulting your money expert is a great idea as they will be happy to hand-hold until you get comfortable with the $VIX.

RISK – Trading options may result in potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the options markets. Do NOT trade with money you can’t afford to lose.